So you’ve started to notice some of the qualitative indicators of product/market fit that that we mentioned in our previous blog post:

- Customers are starting to line up to buy your product

- You’re getting featured in the right blogs and news sites

- New customers are finding you through word of mouth and referrals

It’s starting to feel like it’s time to floor the accelerator and rapidly scale your company. Before you start growing your team, take ten minutes for David Skok’s quantitative assessment to see if you’ve really achieved product/market fit based on two key indicators:

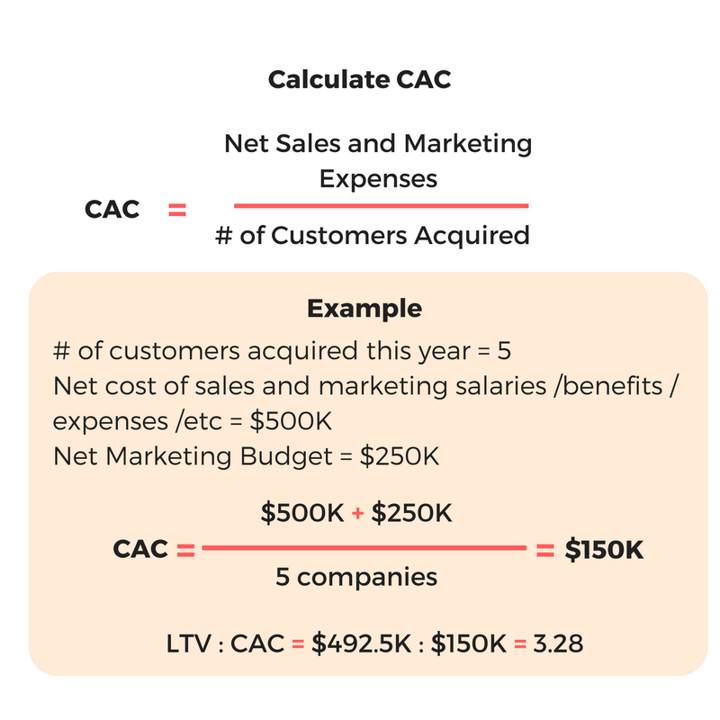

- You have a Customer Lifetime Value (LTV) that is at least 3x greater than your Customer Acquisition Cost (CAC). The best companies have a LTV:CAC ratio of 7-8x or greater.

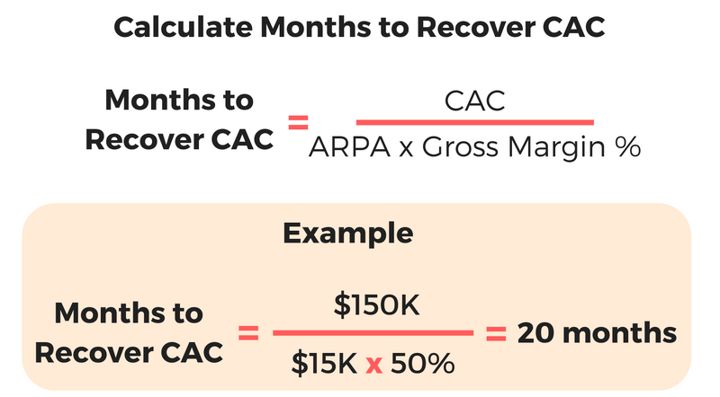

- You recover your CAC in under 12 months. If you can recover your CAC in 5-6 months or less, even better.

LTV:CAC > 3

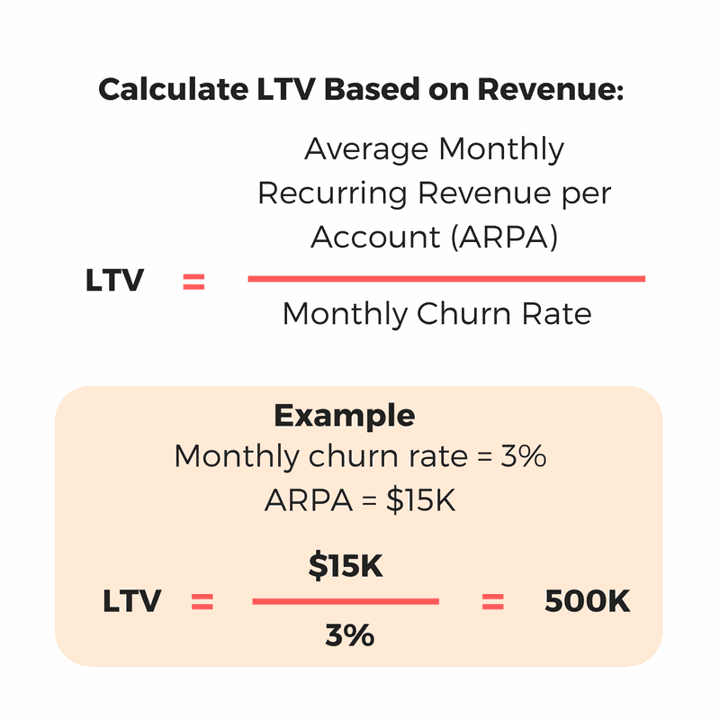

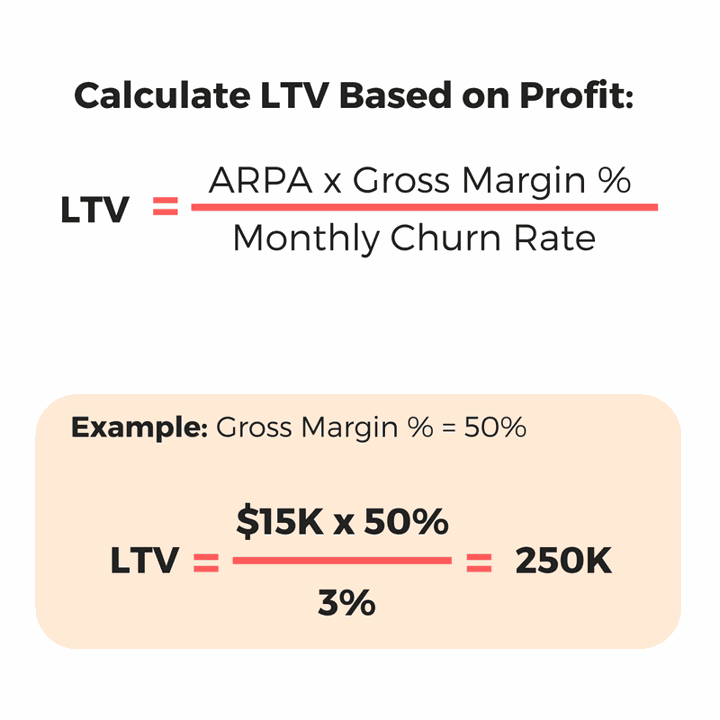

- LTV is the projected profit or revenue (it’s important to look at both) a customer will generate over the course of their lifetime.

- CAC is the cost of sales and marketing necessary to acquire a new customer.

- If you can maintain a LTV:CAC ratio of 3x, every $1 invested in growth will return $3.

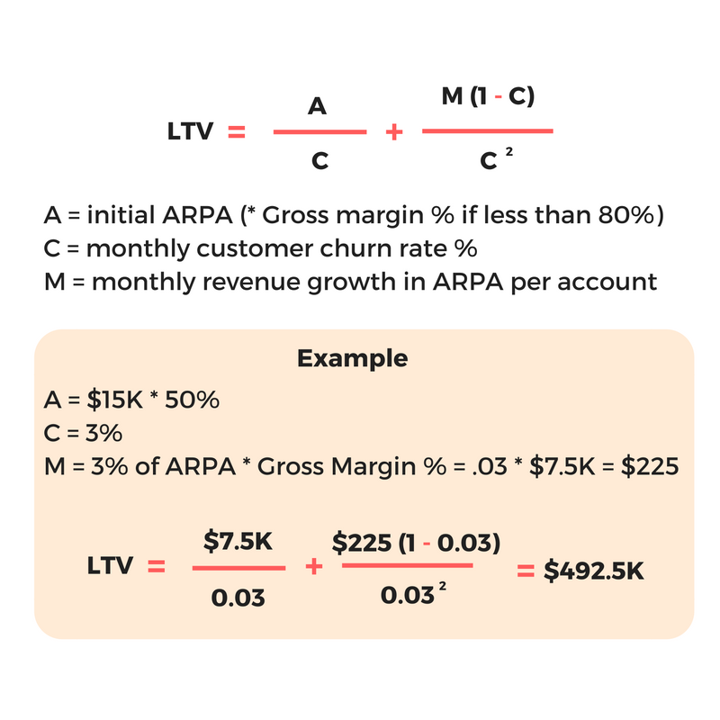

Many software companies have a gross margin that’s greater than 80%. If that’s the case, you can reasonably use the first formula.

Calculate LTV with Negative Churn Rate:

Negative churn rate occurs when your expansion revenue from existing customers is greater than your churned revenue from churned customers. Negative churn is common for SaaS companies with a tiered pricing structure based on a variable axis, such as number of contacts, number of seats, available features, etc.

For companies with negative churn, calculating true LTV can become tricky. Assuming your revenue increases at a fairly constant rate every month over the lifetime of the customer, you can use this formula from David Skok:

As you can see, a negative churn rate of 3% nearly doubles the LTV of the company.

For companies with negative churn that doesn’t increase at a constant rate, David Skok has an awesome calculator on his blog to model True LTV.

This formula may not be accurate in the early days of the startup because some of the people on your sales and marketing teams may command high salaries, but they’re capable of acquiring and managing a greater number of customers as you continue to grow.

CAC is also a great way to analyze different lead sources and decide if you should accelerate spending on them. Divide the budget spent on each lead source by the amount of customers acquired from the source and compare the ROI.

Time to Recover CAC < 12 Months

Recovering your CAC in under 12 months is vital for your cashflow. The faster you regain your CAC, the faster you can reinvest that money into acquiring more customers and exponentially growing your revenue. The best possible situation is to have your clients prepay annually. Your customers are essentially financing your company’s growth by lending you money at zero interest.

In this example, the company has an LTV:CAC ratio of 3.28, but takes 20 months to recover its CAC, indicating it may not be ready to scale. The company should prioritize closing deals with clients that are willing to prepay annually to dramatically reduce its time to recover CAC.

Not Quite There?

High CAC

Are you having a difficult time convincing people to try your product or service? Does it cost an arm and a leg in marketing and sales to get each new customer? You might be trying to sell a solution to a problem that not enough people have and there just isn’t a market for what you are offering.

According to Andreessen, the market is the most important factor in a startup's success or failure, more so than the product or the team. You can have an incredible team and create the greatest product in the world, but if there’s no market for it, you don’t have a business.

Low LTV

LTV is a function of the recurring revenue from a customer and how long they stay a customer. So if your LTV is low, you either are not making enough from each customer, or your churn rate is too high.

The former is an easy fix: find ways to make more money from each customer: experiment with raising your prices, adjust your variable pricing, add new features that cost extra, etc.

The latter is slightly more difficult. The best way to determine the cause is getting feedback from churned customers.

Were your sales people promising things you couldn’t deliver just to close the deal? If so, consider restructuring your commission plan to include a clawback if a customer churns within x months or paying out a quarter of the commission every 3 months of the customer’s lifetime.

Was your product or service not the exact solution to their problem? If so, this is potentially a great situation to be in. You are trying to solve an urgent problem, but you aren’t giving them the perfect solution. To go back to Michael Seibel’s “hair on fire” analogy:

“If your friend was standing next to you and their hair was on fire, that fire would be the only thing they really cared about in this world. It wouldn’t matter if they were hungry, just suffered a bad breakup, or were running late to a meeting—they’d prioritize putting the fire out. If you handed them a hose—the perfect product/solution—they would put the fire out immediately and go on their way. If you handed them a brick they would still grab it and try to hit themselves on the head to put out the fire.”

You found a problem so urgent that people are willing to try anything to solve it, but you’re still handing them a brick instead of a hose.

If this sounds similar to what you’re experiencing: limit your sales and marketing budgets to the minimum level that still lets you interact with customers and determine their pain points and possible solutions. Get as much feedback as possible, and quickly iterate through your v2, v3, v4, and so on until you’ve found PMF.

Tomasz Tunguz has an excellent blog post of 8 Customer Discovery Questions To Validate Product Market Fit For Your Startup.

HireKeep’s latest ebook,“Signs It’s Time to Scale Your Sales Team,” will teach you how to:

- Recognize qualitative indicators of product/market fit

- Determine if you have achieved product/market fit based on the Lifetime Value of a customer and your Customer Acquisition Cost

- Redesign your product based on customer feedback to reach product/market fit

- Analyze each step in your sales process, create an accurate model, and use it to simulate potential changes to your process

- Inspect your sales pipeline to calculate whether it can support more sales reps

- Inspect your sales pipeline to calculate whether it can support more sales reps

- Conduct a break-even analysis on the 3-year return on investment of additional sales people (free Excel spreadsheet included)